World Domination & Mobile Payments

Do you know that the future rests in your palms, literally? Yes, you may have heard this before, some even a million times, and so it’s safe to assume you are indeed thinking of your mobile device. Perhaps a few of my tech savvy friends would disagree and say the future is a chip plunged in their palms; but let fantasies be fantasies, unless invented! But what is invented now is Mobile Device and the sheer capacity of information at your disposal. A complete world in your palms is not an ambitious statement anymore.

What Makes Mobile Payments a Factor For Mobile Domination

Mobile Smart Phone technology is a powerful medium of communication and of course it’s not just for receiving or making calls. The integration of internet, your banks, social networking apps, GPS, to even your Wallet – has made endless possibilities, possible. Everything accessible through your cell phone enables you to make better, smarter and more informed choices. Now you must be wondering how?

Consider this new phenomenon that is making waves across the world. This new phenomena is called Mobile Payments and as the name suggests, it’s about making payments through your mobile phone (using NFC technology). With Mobile payments merchants can now track their customer’s lifestyle and behavior patterns. Moreover, loyalty schemes and offers can be easily promoted through mobile technology and hence, the consumer retention through brand loyalty can be achieved more easily.

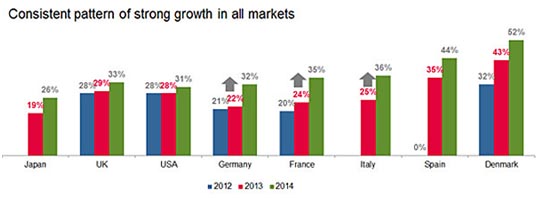

Another interesting aspect to consider is the profiling of each and every customer and its importance in taking key decisions for your businesses. Yes, consumer behavior is easily detected from using mobile payments. And yes, through it, one can easily shape up their business strategy according to the latest trends. But let me now give you a few statistics of how easily mobile payments will become a world dominating factor in consumer behavior:

Reason 1: Mobile Payment &The World Trends

In U.S, 1 out of 3 (30%) smartphone users make mobile payments, where as 17% say they would spend more because of the new payment options. In U.K, mobile payments are already being made at leading retailers and even on motorway tolls whereas, in Asia and Middle-east, we can see the trend rising with new services quickly rapidly increasing by the day.

Reason 2: What the Trends Tell Us

By the end of 2019, the number of consumers using NFC contactless payment services will be approx. 516 million (a more than five-fold increase from 101 million today). Further, it is predicted that by 2020, 90 % of world population over 6 years of age will be a smartphone user. And guess what, with such a massive increase, there would be more NFC based transactions. According to the president of Cardtek USA Gokhan Inonu, the increase in NFC based transactions is not just because the system is fashionable, but because it completes payments quickly and easily than the traditional point of sale system.

Reason 3: Developing Markets

With per capita mobile payment systems in Australia (US$22), U.S.A (US$16) and U.K ($12); it is expected that a sudden uphill climb will be seen by the end of 2015 in the developing world. This is ensured through the fact that in certain developing countries where purchasing an NFC enabled smart phone is out of reach for a ordinary man, Banks and private firmware approaching mobile payments thought a sticker placed on the back of the phone.

Reason 4: Everything on Cloud

With the increased evolution of mobile payments and the simple mechanism it adopts, more businesses will transition if not already integrated into cloud based environment. According to Pascal Nicolas, CEO of POS systems, the revolution enables owners to customize and personalize services for their customers.

Reason 5: Everything Accessed through Your Smart Phone

Who among us has not lost keys your work site or home? NFC-enabled phones allow us to undo the lock of our doors. With NFC, users simply move their smartphone, instead of an identity card, at a reader, as a permit for entry toplace of work, residence, home or other protected areas.

Similarly, everything and anything can be controlled through your smart phone. And with the latest Mobile Payments phenomena acting like your wallet, you will be surprised at the endless possibilities this mode of transaction will bring forth. Let’s not wait too long – the change is just around the corner.